Buying or selling valuable items can sometimes feel overwhelming. One option many people explore is working with a pawn shop. These places have been around for centuries, providing short-term loans, selling items, and buying used goods. Visiting a pawn shop can be a wise choice if you know what to expect. With the proper knowledge, you can get the best deal for your items or make smart purchases without overpaying.

What is a Pawn Shop?

A pawn shop is a business where people can either sell items directly or use them as collateral for a loan. The shop then holds the item until the loan is repaid. If the loan is not paid back, the shop can sell the item to recover the money.

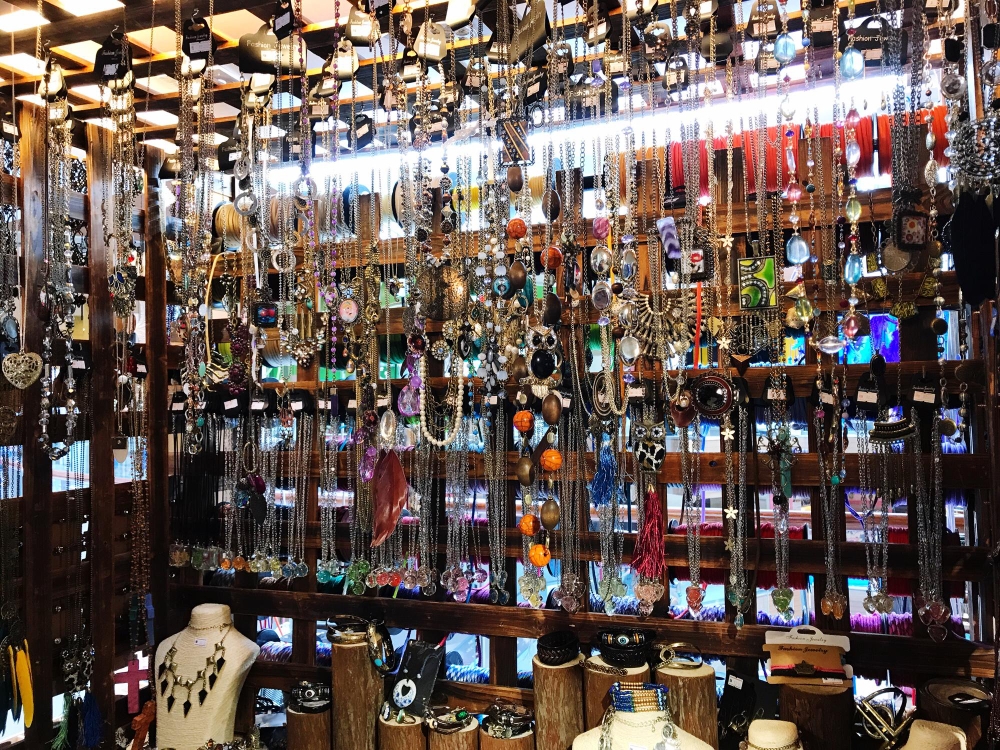

These shops deal in gold, jewelry, electronics, musical instruments, collectibles, and more. They provide a quick and easy way to access cash without going through banks or credit institutions.

They also offer affordable deals on second-hand items. This makes them appealing to buyers looking for unique finds at lower prices.

Why Choose a Reputable Pawn Shop?

Not all pawn shops are equal. A reputable pawn shop ensures fair deals, honest pricing, and transparent transactions. They follow local laws and maintain professionalism.

Choosing a trusted store also reduces the chances of buying fake or stolen goods. Reliable shops test and verify items before buying or selling.

Reputable shops are also known for treating customers respectfully. They explain the value of items clearly and provide safe loan options.

For buyers, this means confidence that the product they purchase is authentic and worth the price.

Benefits of Visiting a Pawn Shop

- Quick Cash Access – You can get money immediately without lengthy paperwork.

- No Credit Checks – Loans are based on the value of items, not your credit history.

- Fair Pricing – Items are assessed based on market value and condition.

- Unique Finds – Shoppers can find antiques, jewelry, and rare collectibles.

- Safe Transactions – Reputable shops follow rules and protect customers.

These advantages make visiting a pawn shop in Framingham an easy solution for both buyers and sellers.

What You Need to Know Before Visiting

- Bring ID – Most shops require identification for transactions.

- Know Your Item’s Value – Do research online before bringing it in.

- Understand the Loan Process – Know interest rates and repayment terms.

- Condition Matters – Clean and present your items in good shape.

- Negotiate Politely – Shops expect some bargaining, but stay respectful.

Being prepared helps you get a fair deal and avoid disappointment.

Key Aspects of Pawn Shops

Pawn shops operate differently from retail stores. Understanding their key features is essential:

- Collateral Loans – Items are used to secure loans, with repayment returning the item.

- Resale Business – Unsold or unclaimed items are resold to other customers.

- Valuation Process – Professionals use weight, quality, and demand to set prices.

- Legal Compliance – Licensed shops follow state and local regulations.

These aspects ensure that both the shop and the customer benefit from each deal.

Steps to Get the Best Value

- Do Your Research – Check online prices before going in.

- Prepare the item by cleaning jewelry, testing electronics, and gathering certificates.

- Set Expectations – Don’t expect full retail price; pawn shops buy at resale value.

- Negotiate Smartly – Be ready to discuss prices respectfully.

- Compare Offers – Don’t accept the first deal; visit more than one shop.

Following these steps increases your chances of getting a better payout.

Questions to Ask the Professional

When you visit a pawn shop, don’t hesitate to ask questions. Here are some examples:

- How did you determine the value of my item?

- What are the loan terms and interest rates?

- Do you provide receipts and documentation?

- How long is the repayment period?

- Can I extend the loan if needed?

These questions help you understand the process clearly and avoid confusion later.

How to Choose the Best Pawn Shop in Framingham

Choosing the right shop is essential for peace of mind. Here are some tips:

- Check Reviews – Look for online reviews to see what others say.

- Verify Licensing – Ensure the shop is licensed and follows state rules.

- Look for Experience – Long-running businesses are often more trustworthy.

- Transparency Matters – A good pawn shop in Framingham will explain the valuation process clearly.

- Customer Service – Choose a shop where the staff are professional and respectful.

A reliable store ensures that every transaction is smooth and fair.

Additional Tips for Buyers

If you’re shopping instead of selling, keep these tips in mind:

- Test electronic items before purchase.

- Ask about return or exchange policies.

- Inspect jewelry for authenticity certificates.

- Compare prices with online stores.

- Always request a bill or receipt.

This way, you can shop confidently and avoid regrets.

Why Location Matters

A local pawn shop is convenient and accessible. Being in Framingham means you can quickly visit, discuss, and finalize deals without long travel.

Local shops also build community trust. Many rely on repeat customers, so they are motivated to offer good service.

Building a relationship with a local shop can even result in better deals in the future.

Common Myths About Pawn Shops

- Myth: They only sell stolen goods.

- Fact: Licensed shops work with authorities and require identification.

- Myth: You get very low offers.

- Fact: While prices are below retail, shops still aim for fair market value.

- Myth: Items are always old and broken.

- Fact: Many shops sell like-new electronics, jewelry, and collectibles.

Understanding these myths can help people trust the process more.

Conclusion

Visiting a pawn shop in Framingham can be a wise decision if you prepare correctly. These shops offer quick access to cash, affordable items, and safe transactions. The key is to choose a reputable and licensed store, do your research, and negotiate respectfully. Whether you’re selling valuables, securing a loan, or looking for a bargain, the experience can be rewarding when handled wisely. Always ask questions, understand the process, and compare options before finalizing a deal.